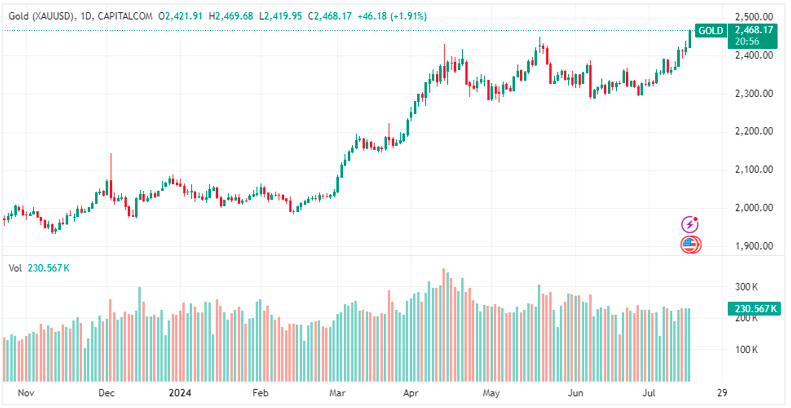

US inflation impact on gold price has driven the metal to a new record high of $2,465 on Tuesday. This is due to growing expectations that the US Federal Reserve will start its easing cycle in September. This, along with the increasing likelihood of former President Donald Trump’s victory in the November election, has supported the yellow metal. The XAU/USD is trading at $2465, gaining over 1.70%.

Lower-than-expected consumer inflation data last week boosted non-yielding metal prices amid the Fed’s dovish stance. The CME FedWatch Tool indicates a 100% probability for a 25-basis point rate cut in September, with a small minority of economists predicting a 50 bps cut.

Additionally, political developments involving former President Trump over the weekend gave a boost to gold. Trump’s potential presidency would likely increase tariffs and cut taxes, increasing the US budget deficit and creating inflationary pressures.

Economic Data and Fed’s Comments

Meanwhile, Fed Chair Jerome Powell spoke at the Economic Club of Washington, noting the economy’s strong performance and stating the Fed will lower borrowing costs once confident that inflation is moving toward the 2% target.

The US Census Bureau reported that June Retail Sales remained unchanged, as expected. However, excluding autos, sales increased significantly, surpassing forecasts.

Market Movers: Gold’s Ascent Despite Mixed US Data

Weaker-than-expected US Consumer Price Index (CPI) data supported gold’s rise above $2,400, with increased odds for Fed rate cuts, reflected by declining US Treasury bond yields.

June Retail Sales in the US were flat at 0% month-on-month, as predicted. Core sales grew by 0.4% month-on-month, exceeding the expected 0.1%.

June Export and Import Prices both fell, with Export prices dropping -0.5% month-on-month, below the forecast of -0.1%. Import prices rose compared to May’s -0.2% decline, remaining flat at 0%, below the expected 0.2% increase.

Meanwhile, the US Dollar Index (DXY), which measures the Greenback against a basket of six currencies, is up by a minimal 0.02% at 104.27.

Technical Analysis and Future Outlook

US Inflation Impact on Gold continue to remain bullish and trade at all-time highs, surpassing the May 20 high of $2450, paving the way for further gains. Momentum favors the bulls, as shown by the Relative Strength Index (RSI), which is close to reaching overbought conditions.

XAU/USD’s next resistance level is $2,475, followed by the $2,500 mark. Conversely, if gold prices drop below $2,450, the first resistance level will be $2,400, followed by the July 5 high at $2,392. If surpassed, XAU/USD could continue to $2,350.

For more insights and daily updates, visit Daily Gold Signal. You can also check the latest gold updates at this external link.